6 Months of Sideways? Bitcoin Price Action Mimics 2023 Stagnation

Bitcoin (BTC) has months of consolidation left if the initial bullish market behavior repeats.

In his latest market commentary, prominent analyst Rekt Capital has drawn fresh comparisons between BTC price action this year and 2023.

BTC Price Forms “Similar Range” in 2023

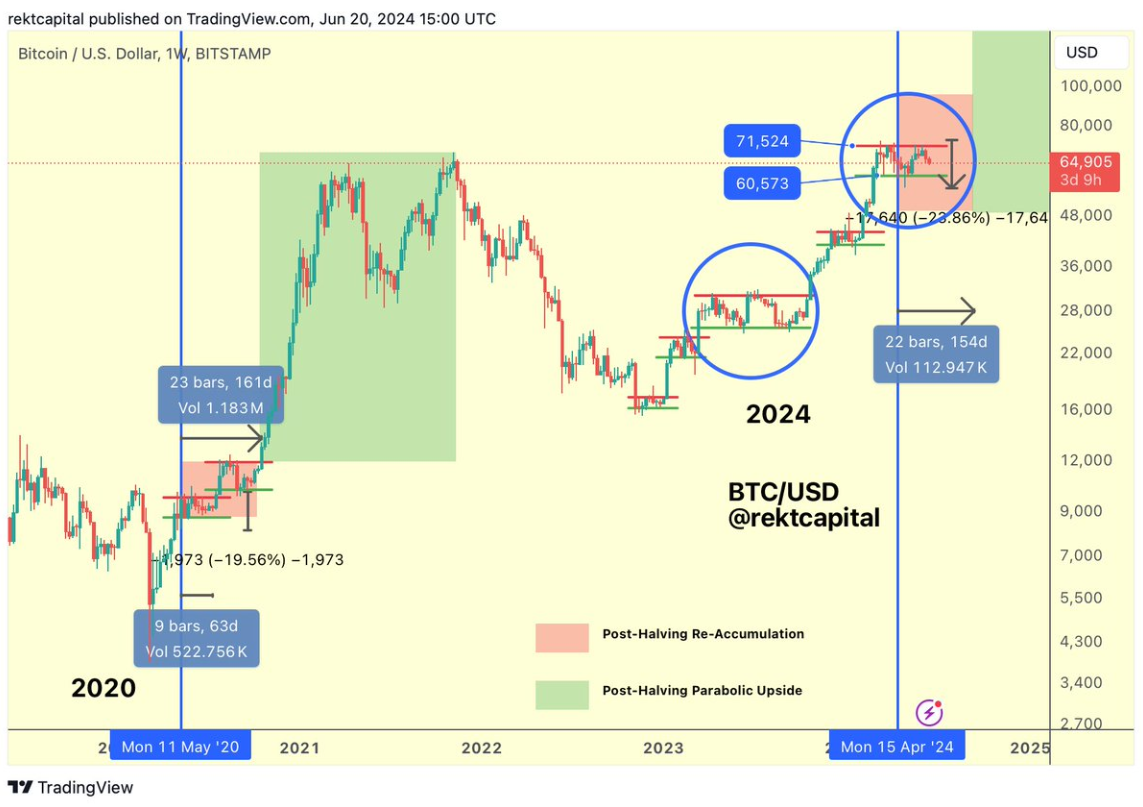

Although Bitcoin has been tightly range-bound since the latest halving in April, investors should not be worried by the move, Rekt Capital said .

Looking at past and current Bitcoin bull market phases, he pointed out that even last year, BTC/USD experienced prolonged periods of volatility.

“Bitcoin tends to form a Consolidation Range after the Halving event.

We have also seen Bitcoin form a similar range in this cycle (blue circle)”.

BTC/USDT Weekly Chart | Source: Rekt Capital

The accompanying chart directly compares the current situation to a multi-month consolidation period from Q2 to Q3 2023.

If this repeats, Bitcoin will remain in the current range for a few more months.

Meanwhile, another analysis suggests that this week’s BTC price correction is “overdue.”

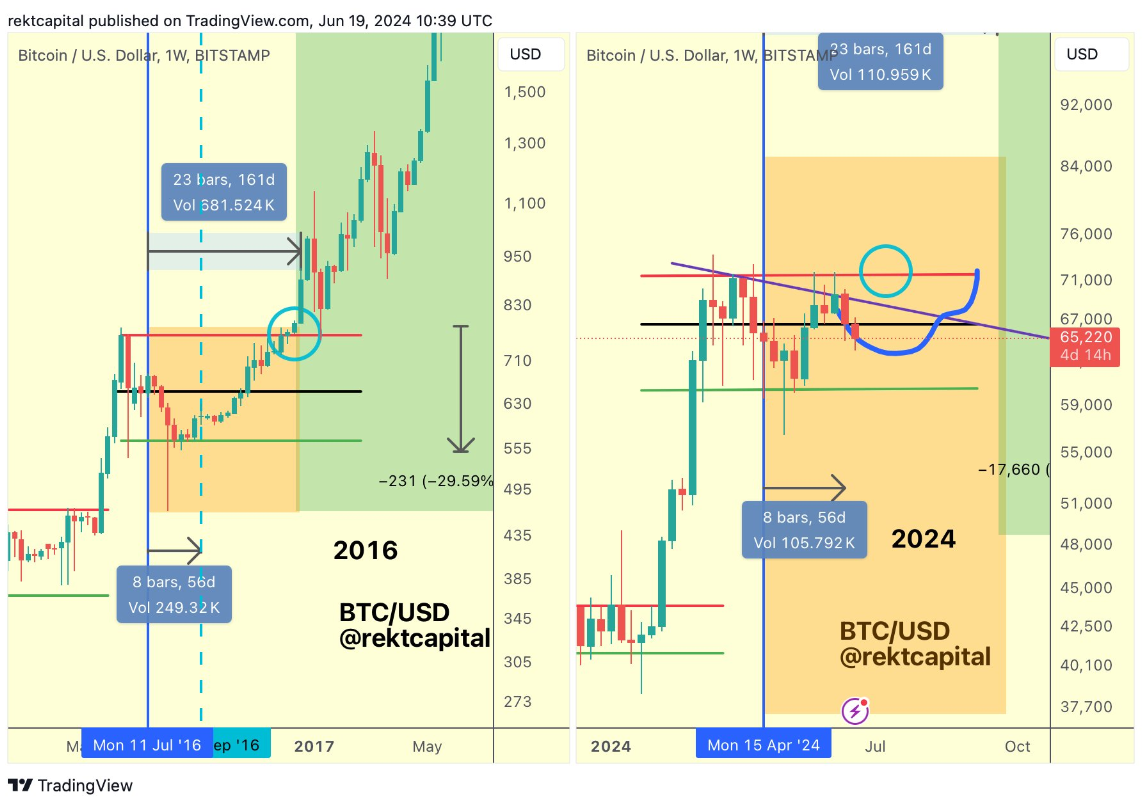

Here’s a chart comparing 2024 to the early stages of the Bitcoin bull market in mid-2016.

Bitcoin Hash Rate in Limbo with Price

As Bitcoin Magazine reported, the “re-accumulation phase” is reflected not only in price but also in miner activity.

Since the halving event cut the reward of each block by 50%, a new “capitulation” has begun, according to the popular Hash Ribbons metric .

This metric compares the 30-day average hash rate to its 60-day equivalent, and when the 30-day hash rate falls below the 60-day hash rate, “capitulation” sets in. Historically, such periods have presented good buying opportunities, with the last one occurring in Q3 of last year.

“I know this isn’t fun, but BTC won’t break all-time highs until more pain and boredom sets in,” Willy Woo, creator of on-chain analytics platform Woobull, commented on the phenomenon.

“The bright spot is that miners are capitulating and when that ends, it almost always ends with a strong rally. Look for compression in this range. Buy and hold in these areas.”